How To Farm BAO - Liquidity Bootstrapping & Farming for Yield

Creating Synthetic Assets from Uniswap LP Tokens

Read First: In this post, I’m going to cover BAO finance and how to buy, become a liquidity provider, and then stake tokens for handsome BAO rewards.

At the end of this article, I will ask that you subscribe for the free substack here in return .

I hope you get great value out of this walkthrough.

UPDATE:

BAO has mooned. The Big Brains Mastermind group members got this info back in December. We’ll be trying to help expose others to similar opportunities in the future. If you’re interested, you need to subscribe to our paid tier now . You’ll be first to see new opportunities, and you can join our private Big Brains Mastermind chat server. Free subs also get access to our general chat.

What is BAO?

BAO stands for "Balancing, Automation and Options"

BAO is a very new project. It is only a few weeks old.

So new, it’s not even listed on the tracking sites like Coingecko or Coinmarket cap at the time of this article’s publishing.

BAO finance is a proposed synthetic asset and margin trading protocol, which will build on top of existing projects. We’ll see forks of systems like Synthetix and Aave to build an ecosystem of alternative financial instruments.

In the initial FAQ, the BAO team states the intention or users to use Uniswap V2-LP tokens as collateral to mint synthetic digital assets.

BAO states that they are utilizing and forking other existing, proven codebases to compose new functionality and trading instruments.

The BAO Token represents the governance (voting and control) of the activities of the protocol, among other features.

BAO Token can be used in the BAO ecosystem for:

Vote in governance polls.

Create governance proposal.

Decide on new features and devs.

Elect oracles for pricing synthetic assets.

Remove oracles for pricing synthetic assets.

Decide which synthetic assets to create/list/remove.

What We’re Doing

We are going to go over how to farm this very early project to help bootstrap its liquidity and reap farming rewards in the form of BAO token.

Note: This phase of the project is issuing a LOT of BAO tokens. It is not advised to buy and hold, as the issuance of new tokens is guaranteed to make buy & hold a loss - BIG time. We MUST be staking.

Prerequisites

WARNING: This is an advanced operation. You should have staked/farmed at least one pool and gone through process of becoming a liquidity provider. You should have some ETH to buy BAO. You should understand you’ll probably lose all of your capital.

BEFORE YOU START

FIRST: Visit the BAO Website and read their documentation.

^——You must do your own research—^

Get BAO

Again, read some of the reasons not to use BAO

The only place to buy BAO directly is on the Decentralized Exchange (DEX) Uniswap.

Visit the uniswap address for the BAO/ETH token pair:

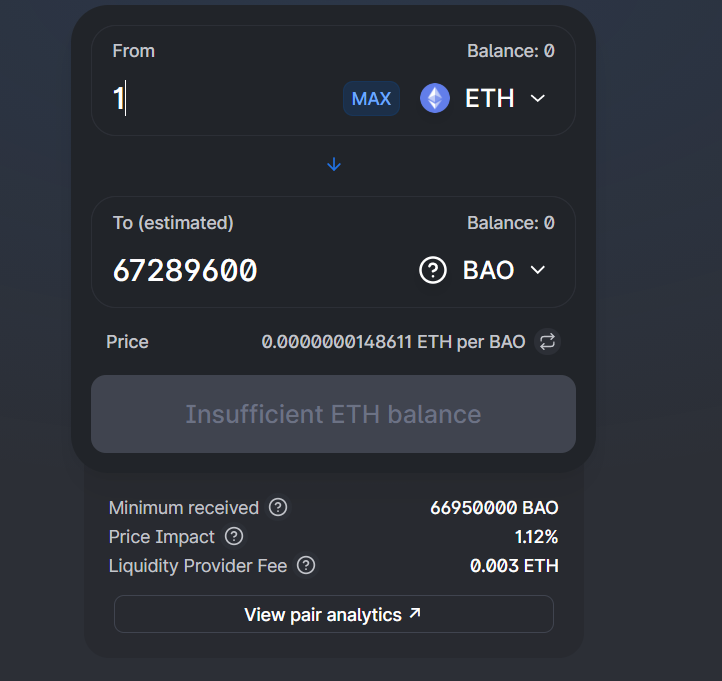

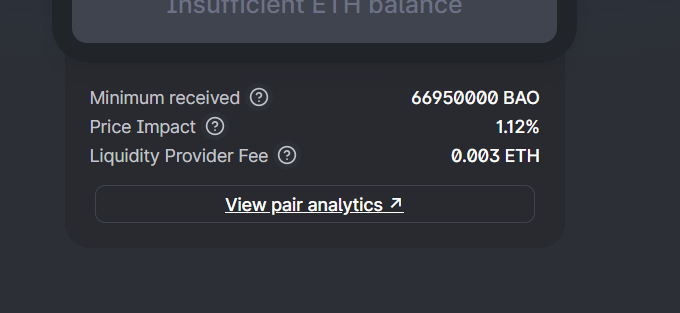

Swap your ETH for BAO

First approve, then swap.

(PS I’m using an empty account here for demonstration purposes)

After Swapping, wait for the transaction to complete

Get Uniswap Liquidity Provider Tokens for ETH-BAO

After you’ve got your BAO confirmed in your wallet, we need to get the Liquidity Provider Token, which will be used to “farm” in later steps.

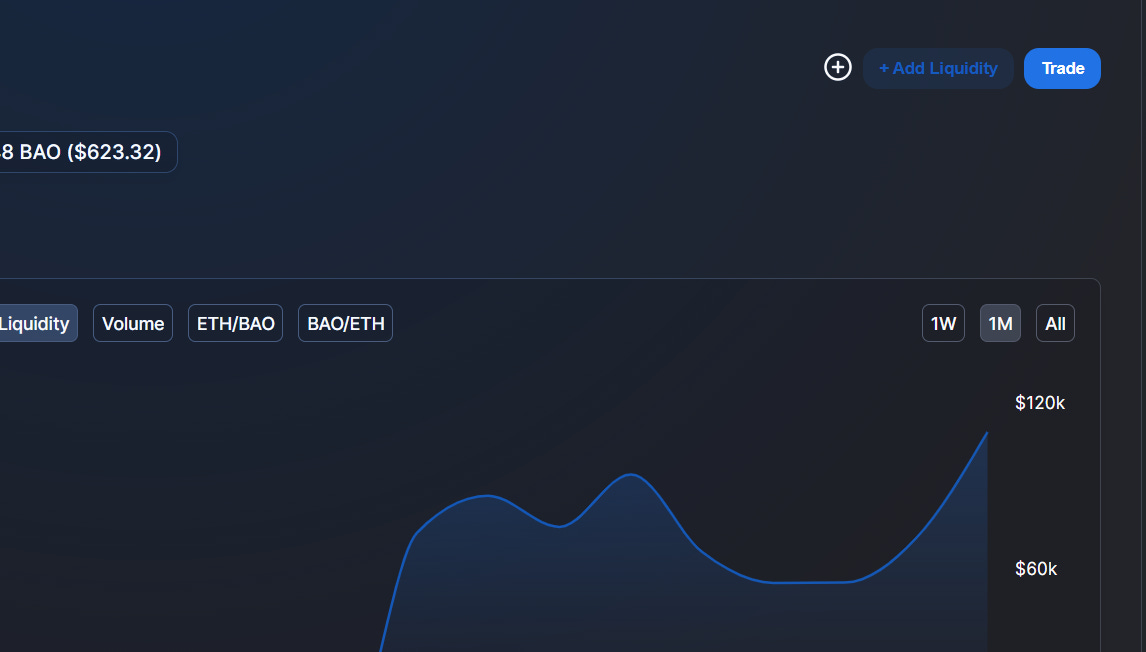

Click the “View Pair Analytics” pictured below.

This should take you to the following BAO-ETH Pair URL:

https://info.uniswap.org/pair/0x9973bb0fE5F8DF5dE730776dF09E946c74254fb3

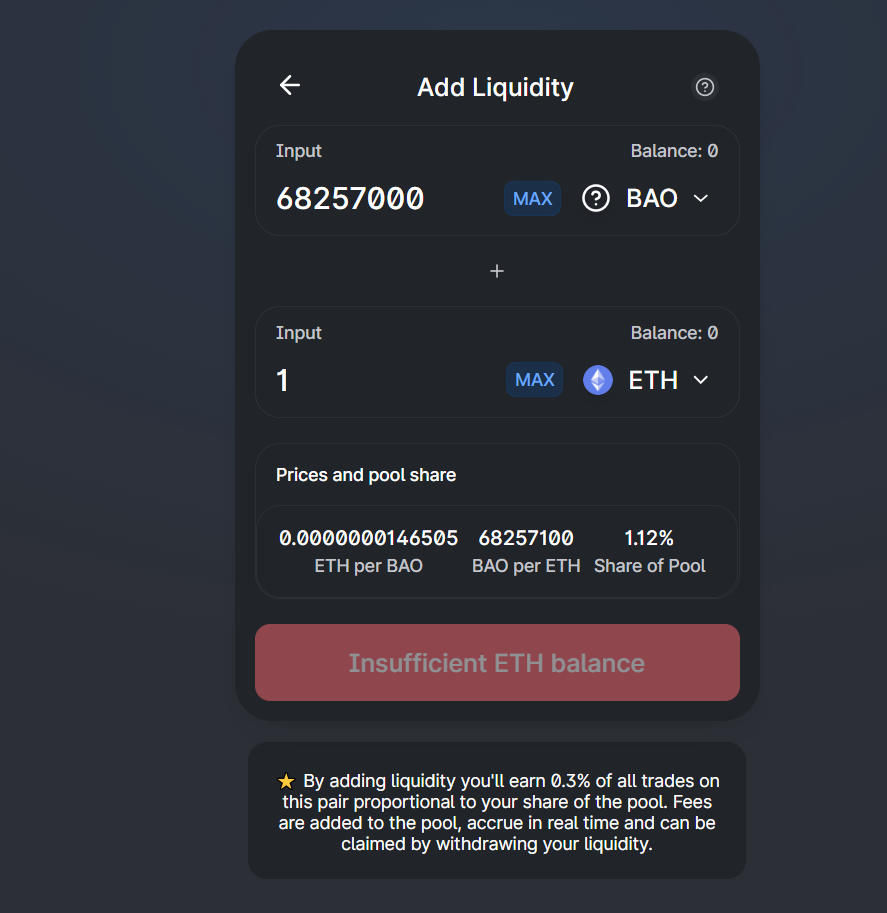

On the top right of the screen, click “Add Liquidity”

It will take you to the URL for liquidity pair creation here:

https://app.uniswap.org/#/add/0x374cb8c27130e2c9e04f44303f3c8351b9de61c1/ETH

Approve and Add the Liquidity

This will create a new BAO-ETH UNIV2 Token credited to your metamask wallet, which represents the rights to trading fees generated from your token pair.

This is what the BAO Site requires for maximum staking rewards.

Staking BAO-ETH UNIV2 Token to Farm BAO

Head on over to the official BAO Website

In the top right of the screen, “Unlock Wallet”

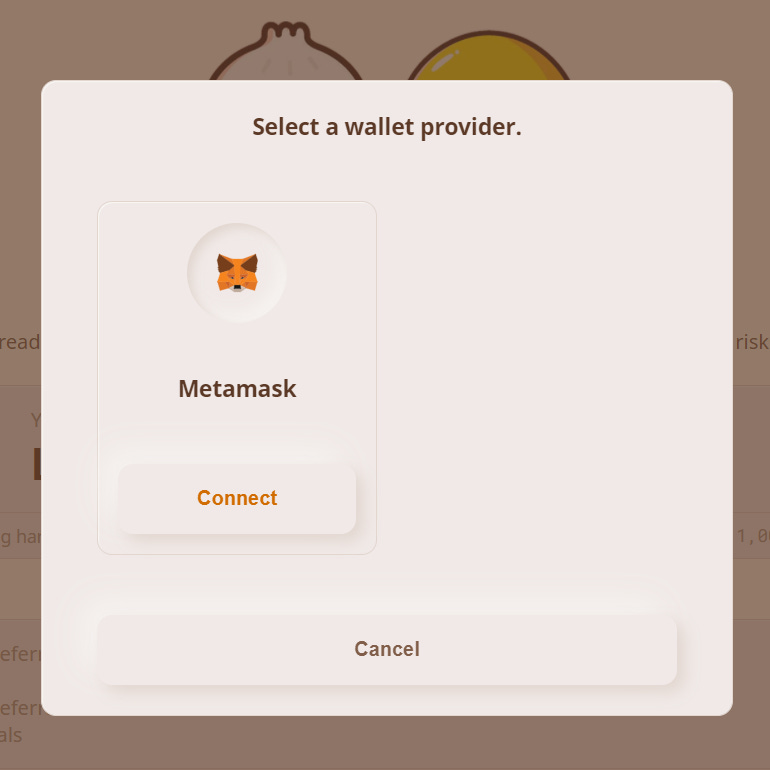

Select your wallet (metamask is what we use)

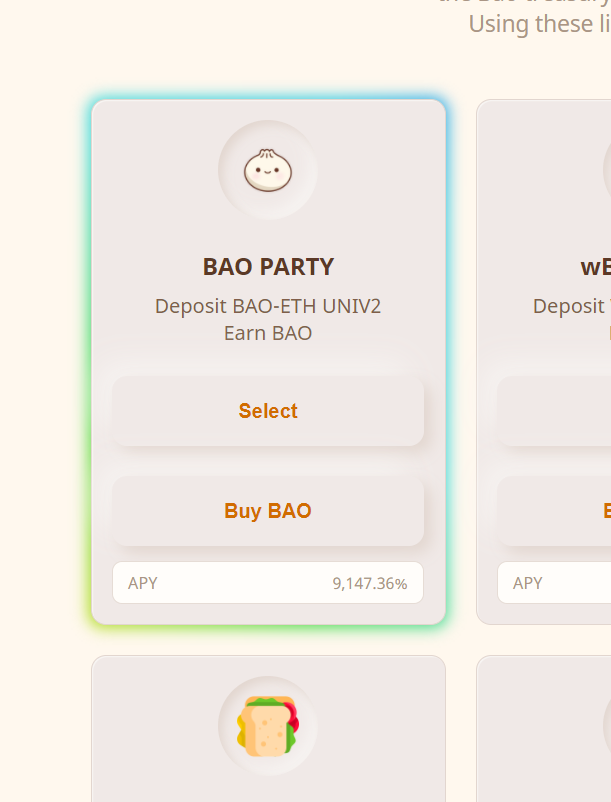

Click “Menu” at the top of the page, which should take you to the farming page.

The first entry is our destination, where it says “Deposit BAO-ETH UNIV2”.

Select this.

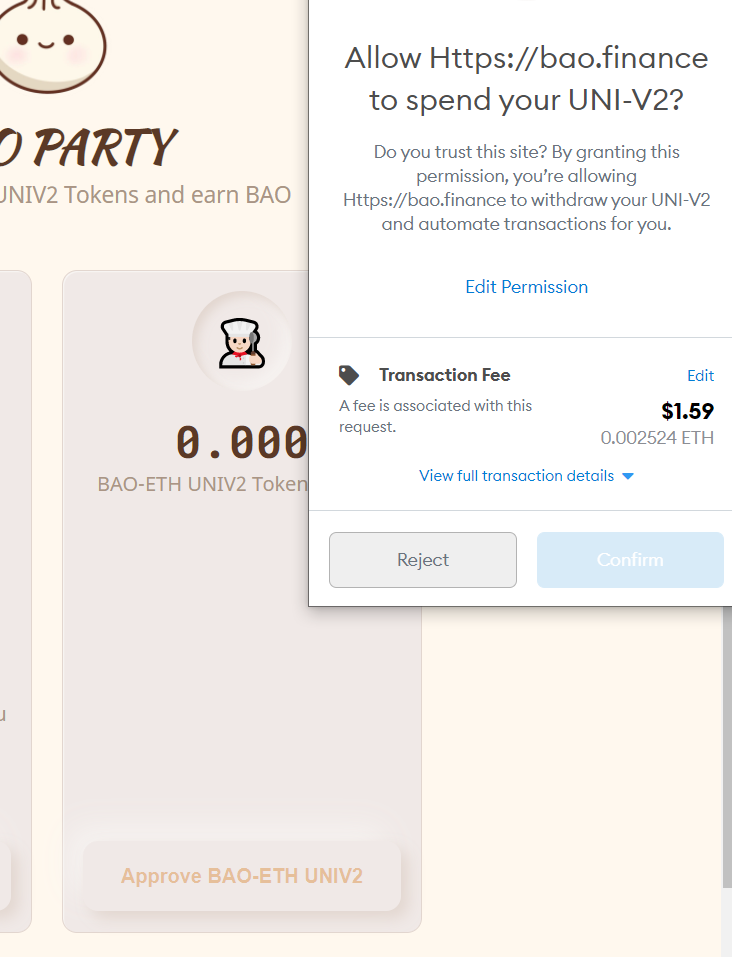

On the BAO-ETH UNIV2 Page, You must APPROVE bao.finance to hold your tokens.

The metamask approval pane should look similar:

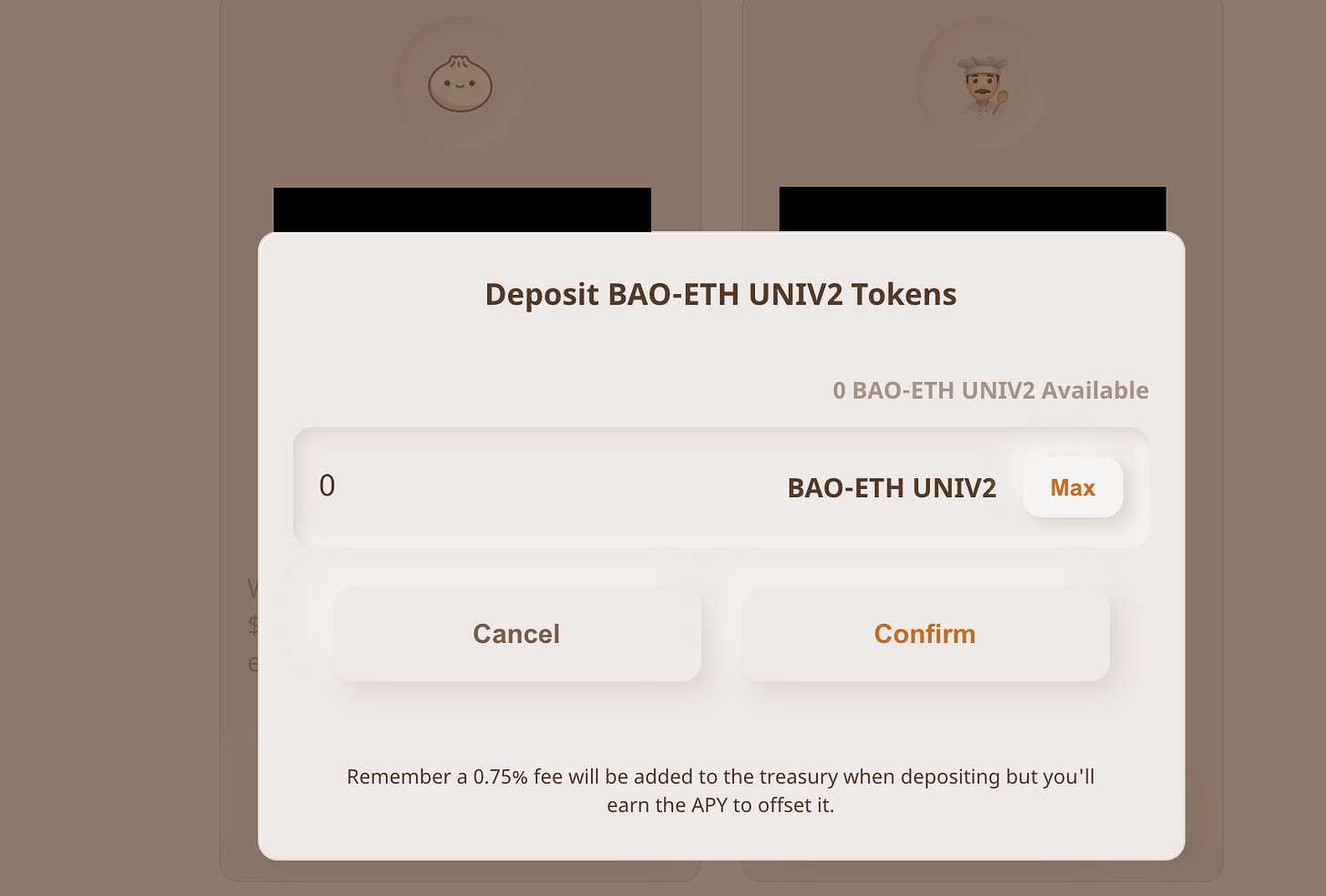

Once Approved, a “Stake” Option should become available. Click the “+” Icon to the right of the Stake Button in order to add .

Note: Your balances will all automatically show up in these interfaces. I am using an empty account to grab screenshots.

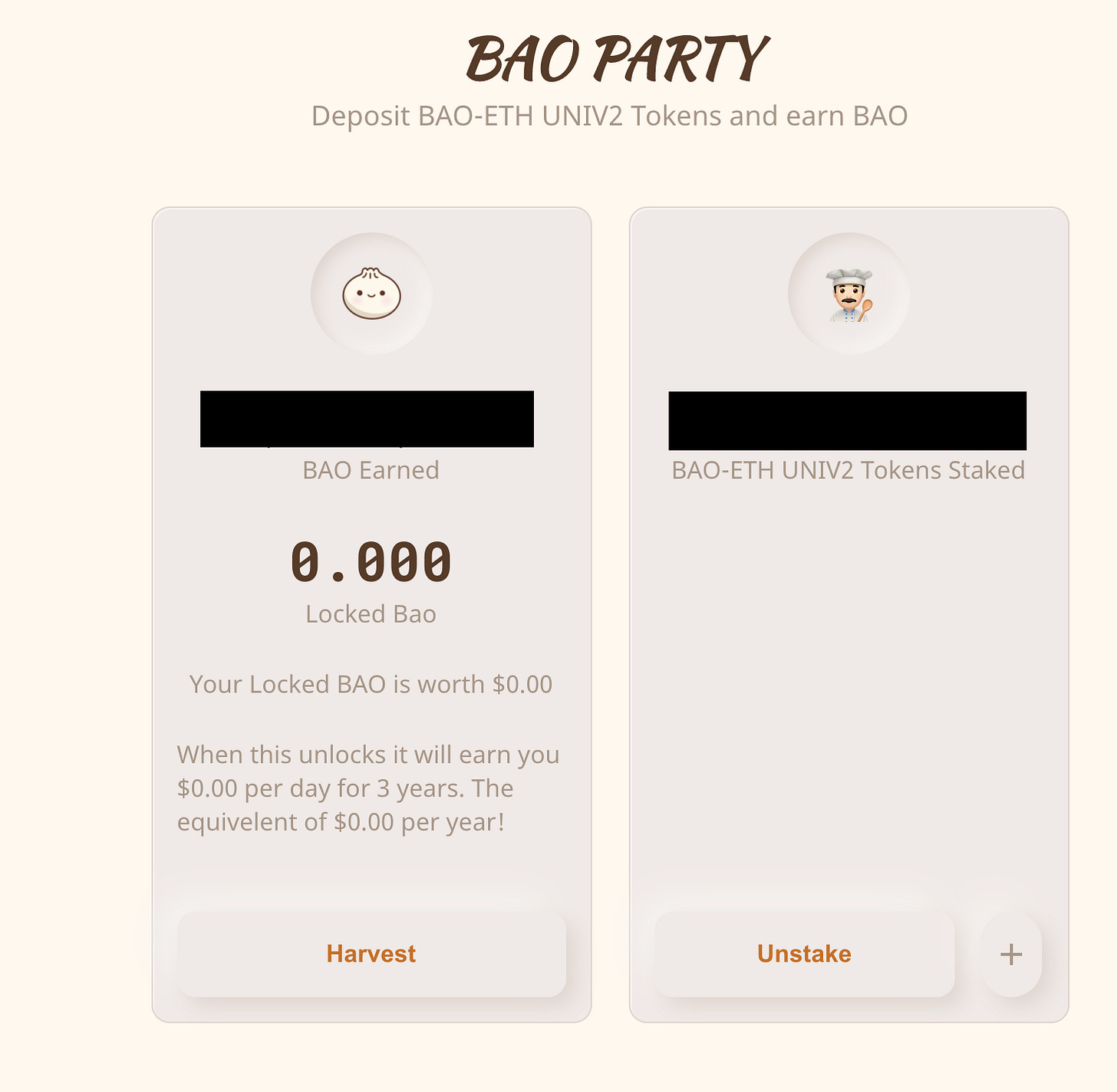

Once you’ve confirmed and the transaction completes, you will now be earning BAO

Unstaking and Claiming Rewards

You can remove your LP Tokens At any Time, then Remove them from Uniswap pooling . Alternatively, if volatility heats up for ETH-BAO, you could keep the LP and make trading fees from the LP Tokens.

Keep in mind, you will experience varying balances after unstaking LPs. Please make sure you understand how LP tokens work before doing this activity.

Harvesting your locked BAO triggers a timer to start releasing 95% of your BAO to you after one year on a 3 year trickle payout schedule.

The other 5% is unlocked immediately for you to own.

Again, you will be streamed your rewards over the course of 3 years after the 1 year holding period.

This is to discourage mass whale sell-offs and retain ecosystem participants over the long term.

Did this Help?

Donate a tiny amount of BAO, ETH, or other ERC-20 token to our Chainwave Public Portfolio because 10% of profits are going to a Puerto Rico Charity.

0x76ba1bae4ca324d966750f449a2548df6ada8347

I provide tutorials, how-tos, and features on new DeFi and blockchain projects. This is also a brain dump for pie-in-the-sky ideas, community, and conversation about what we can do with blockchain technology.

If you got any value at all out of this, please subscribe for free to get this type of content and join our exclusive community of blockchain and DeFi enthusiasts.

Hello, I have done the staking. Once you press Harvest it triggers a timer of a year. My question is, the second time I press Harvest does that one apply to the time started already ? or It creates another timer of 1 year?

I dont get it. I bought bao from uniswap. I opened a wallet on bao website then i get to deposit bao-eth tokens and when i put a number in it says a massive cost and insufficient funds. Do i get to choose how much bao i want to put in?? Do i have to buy bao with on uniswap again to loqd it?? Or can i choose to put a specific amount. I do only habe 14 bucks usd left in my account. Does that count? So confused lol